Our Expertise

Get a sneak peak of what our clients are putting into practice.

First Quarter Update From Horst & Graben

“History doesn’t repeat itself, but it often rhymes.” –Mark Twain

Happy spring! We hope that this note finds you and your families well. We’re here with positive news: After a great fourth quarter in 2023, we’re wrapping up a great first quarter in 2024.

Happy New Year

Happy New Year “May we all come through safe and with Honour”. Winston Churchill

We hope our note finds you and your families doing well. We can’t believe we are already into 2024 and the new year is moving full speed ahead. The last 2 months of the year ended on a high note from a market performance standpoint, which after an up and down year was welcome news.

2023 Year-End Housekeeping

We hope our note finds you and your loved ones doing well. As we head toward the end of 2023, we wanted to provide a quick market update and clarify some year-end deadlines.

A tale of two economies

Heading into the final quarter of 2023, we are looking back on a year of growing pains, between moving offices and changing custodians. We want to thank you for your patience with us through this process. Regrouping and taking stock before the next step are a part of how we all approach life, and we are excited to be making this pit stop in our temporary office before welcoming you in mid-2024 to our permanent home, in a building we co-own.

Two moves are better than one.

Over the years, your support and trust have contributed significantly to the growth of our company. I’m thrilled to announce that we have purchased a building with some of our trusted partners, and we will soon be moving into a more spacious and productive office space in Raleigh Hills, just north of our current location.

Schwab Transition Coming 9/1

Only a little more than a week remains until the transition of your accounts from TD Ameritrade to Schwab, which will occur over Labor Day weekend (September 2-4). I know you’ve been inundated with emails and mailings from us and from Schwab, so I wanted to cut through the noise with some fundamental facts. Feel free to print this and put it on your fridge or in a file to reference over the coming weeks.

Schwabitrade Is Coming!

We are a little less than two months away from the transition of accounts from TD Ameritrade to Schwab. If we manage accounts at TD Ameritrade for you, you should have received a letter in the mail recently from TD Ameritrade reminding you of this transition.

A Bit of Housekeeping…

We are enjoying the first sunny period of the year here in Portland! In the vein of spring cleaning, here are some things we’re looking forward to getting off our desk.

“Schwabitrade” Cometh

For our clients with accounts at TD Ameritrade, you’ll soon be getting some notices regarding the merger with Schwab. Accounts will move to the Schwab side of things over the Labor Day weekend, but in advance you’re going to receive a few things—and don’t worry, we will stay in close contact with you during this process:

Getting Ahead of Tax Time

If you’ve already finished filing your 2022 tax return—congratulations! If you haven’t, commiserations and good luck. Because those wounds are still fresh, we wanted to take this opportunity to review some strategies around tax planning that we’ve implemented in recent years to try to help save you money, either now or down the line. Below we’ve listed some strategies that help working and retired clients alike, as well as those who are charitably minded, so read on to see what might fit you best.

FDIC Insurance

It’s been an uneasy couple of weeks for anyone with a bank account in the United States—so just about everyone. We wanted to reach out to calm some fears and let you know what actions may be advisable in the wake of the collapse of Silicon Valley Bank. We will address five things in this newsletter.

New Year, New Laws, New Planning Opportunities

In the waning weeks of 2022, Congress passed some changes to retirement plans that have been called Secure 2.0. While we won’t go through each and every change, we wanted to briefly review some of these that may have the greatest impact on our clients. Though implementation has been delayed until 2024 for many provisions, giving folks a chance to update software and regulations to match, some changes have taken effect immediately.

2022 Year-End Housekeeping

As 2022 draws to a close, we want to wish you and your families a happy holiday season. This was an extremely tough year for the capital markets, and we are excited and cautiously optimistic about 2023. Thank you for your continued support and confidence during these tough times.

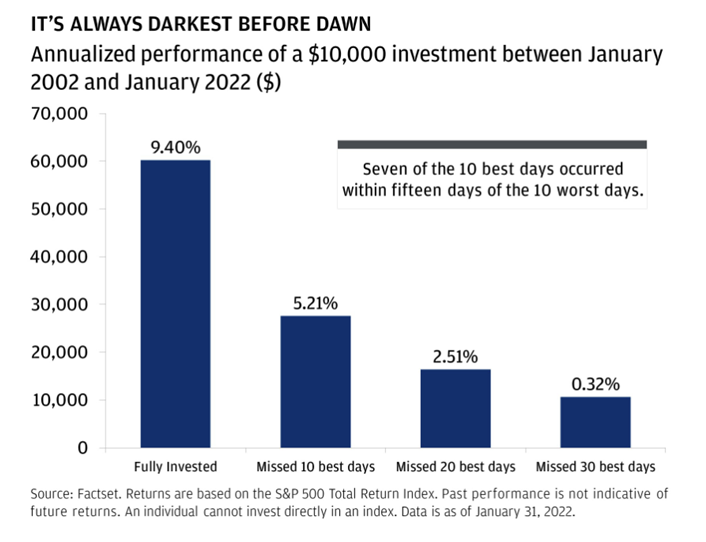

Bearing Up in a Bear Market

No bones about it: 2022 has been an extremely tough market year, and the latest downturn at the end of the third quarter pushed us into a bear market within the major stock indices. A bear market describes a prolonged drop in stock prices where the indices drop by 20% or more. Our advisors have lived through many different market cycles, from Y2K to the Dot-com bubble, September 11th to the Great Recession, Russia invading Crimea, Brexit, COVID, and the current period of high inflation. We have seen the markets swing from excessive enthusiasm to extreme pessimism. Through each of these periods, Wall Street has encouraged investors to make the decisions of six months ago – buying high and selling low, and staying out of the market as it begins to recover.

Student Debt Relief: Forgiveness is Just One Piece of the Pie

One in seven Americans has student loan debt, and over 90% of that debt is held by the federal government. This made the White House’s recent reforms to its student loans impactful for roughly ten percent of the population. It is important to note that these changes only apply to federal borrowers, and not to privately held loans.

Year-to-Date Market Recap

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” –Seth Klarman

We hope this note finds you and yours doing well. As summer draws to a close and the school year begins, we have been reflecting on a crazy year – from the drawdown of the pandemic to the Russian invasion of Ukraine, stubbornly high inflation to daily political drama, and plenty of stock market volatility into the bargain.

Roth Conversions: An Alternative to Sitting Tight

While history shows us that the best thing we can do during a down market is to sit tight and not make major changes to investments, it’s often easier said than done. As we’ve shared over the past several months, in response to this year’s difficult market performance so far, we’ve made tweaks within our models, primarily to tip toward funds that tend to prove more resilient in times like these. This is an action based around investments, but certain planning opportunities have opened up too. The Roth conversion process we’ll describe below isn’t the best fit for everyone, but if you feel like it fits you and are interested, feel free to reach out to us.

When the Going Gets Tough...

What is causing this volatility? The markets have been shaken this year by a flurry of investor worries. For one thing, inflation is at its highest rate in decades. This has forced the Federal Reserve to kick off a monetary policy tightening campaign, which includes increasing interest rates, and the markets are trying to figure if that’s doable without tipping the country into a recession. On top of these fears, we are dealing with geopolitical factors: strict pandemic lockdowns in China, Russia’s invasion of Ukraine, and ongoing political conflicts within the United States.

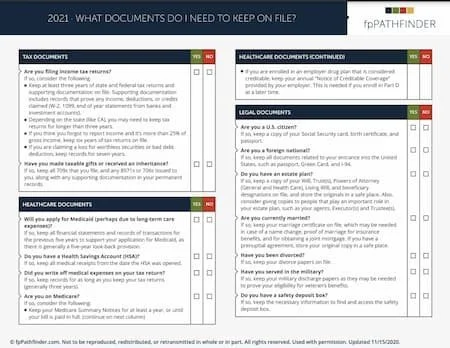

Spring Cleaning Means Shredding

We hope you are looking forward to a well-deserved mental break with the tax filing deadline coming up. Spring cleaning is on the brain – we often get asked by clients, “how far back should I keep my financial documents?” Whether you are inundated by paper files or just want to avoid getting there, let’s walk through some general recommendations.

Keeping Things in Perspective

I know you've been receiving a lot of emails from us over the past couple of weeks, but with the situation in Ukraine growing more volatile, I wanted to reach out with further updates. We typically tweak our investment models on a quarterly basis, but we have made recent changes in response to the ongoing economic impacts of a war in Eastern Europe. In our view, the war itself as well as the sanctions enacted in response could continue to impact the broader European economy, global inflation, and energy prices.

An Economic Update on the Situation in Ukraine

We have received many messages from clients over the past few weeks about the conflict in Ukraine and how it may affect your portfolio. With things unfolding at a rapid pace, we wanted to reach out with the latest information and our recommendations.