An Economic Update on the Situation in Ukraine

We have received many messages from clients over the past few weeks about the conflict in Ukraine and how it may affect your portfolio. With things unfolding at a rapid pace, we wanted to reach out with the latest information and my recommendations.

First of all, We hear you – this is a scary and sobering time. Many people have lost their lives and many more are fleeing their homeland. It’s a horrific tragedy, and we don’t know what may happen next. We’re not qualified to talk about the political or humanitarian aspects of this crisis, but we can talk about how the world economy and markets are being affected by this, and how it might impact you. Here’s what’s happened so far:

Several major Russian banks have been cut off from SWIFT, the most widely used global technology used by banks to send funds across borders.

As a result of this and other sanctions, the value of the Russian ruble has cratered.

Russia’s central bank holds over $600 billion in foreign currency (the dollar, pound, Euro, and yuan) overseas as an emergency fund, to be used to prop up the value of the ruble. However, further sanctions by the US/UK/EU have largely frozen Russian access to these funds, allowing the ruble to nosedive freely.

It’s worth asking, where does Russia impact the global economy? The answer is in the energy sector. Russia is one of the world’s largest exporters of fuel, producing 11% of the world’s oil and 17% of its natural gas. The US is both the world’s largest producer and consumer of crude oil at 20% of each, but Russia has less consumption so sells much more, primarily in Europe. We have seen fuel prices rise in the short term, but other major oil producing countries have already indicated they’ll increase their supply in response.

What is our action plan? Stay invested. Although we’ve had a rocky start to the year in the domestic markets, fundamental indicators like wage growth, unemployment, and household balance sheets indicate that the domestic economy is healthy.

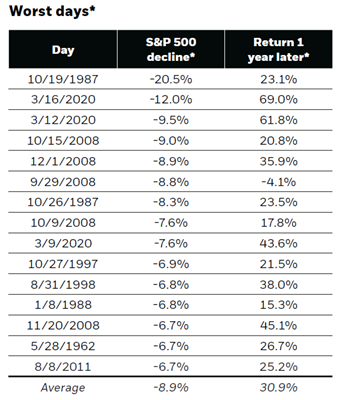

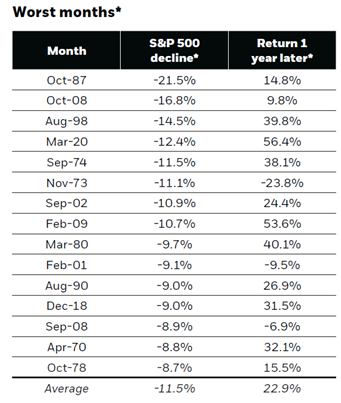

As we always say, the markets hate uncertainty, and there is plenty of that here. It can be so tempting to change to an ultra-conservative model to avoid further downturn. However, that also locks in losses we’ve already seen. The graph below from Blackrock shows what the markets looked like a year after the worst days and months since 1950, and only very rarely was performance still down one year on. The prudent move is to stay invested and to stick to your long-term plan.

“Sources: BlackRock; Morningstar as of 12/31/21. U.S. stocks are represented by the S&P 500 PR Index from 3/4/57 to 12/31/21 and the IA SBBI U.S. Lrg Stock PR USD Index from 1/1/50 to 3/4/57, unmanaged indexes that are considered generally representative of the U.S. stock market during each given time period. Index performance is for illustrative purposes only. It is not possible to invest directly in an index. Performance does not guarantee or indicate future results.”

If your plan includes making IRA or Roth IRA contributions, this is actually a great time to buy at a discount. Whether you are funding for 2021 before you file your taxes, or getting a jump on 2022, feel free to get in touch with me to start that process if that works for your budget.

We know it’s one thing to say we’ll stay the course during a tough time in the market, and quite another thing to put that into practice when it comes. That’s why we are here, and we encourage you to reach out to us if you need that support in sticking to your plan.