2022 Year-End Housekeeping

As 2022 draws to a close, we want to wish you and your families a happy holiday season. This was an extremely tough year for the capital markets, and we are excited and cautiously optimistic about 2023. Thank you for your continued support and confidence during these tough times.

Our office and the markets will be closed on December 26th in observance of Christmas Day and January 2nd in observance of New Year’s Day.

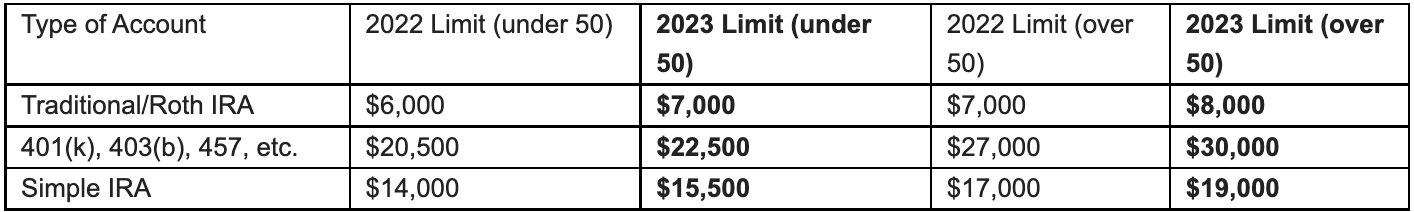

Contribution limits for retirement accounts are increasing yet again in 2023, and substantially:

This is a great time to review your autopilot contributions and make adjustments, including for IRAs and Roth IRAs. We will be reaching out to clients who are making monthly contributions based on 2022’s maximum number to see if you’d like to increase your regular additions.

Other items of note:

The standard deduction for single filers will increase by $900 and for married couples filing jointly will increase by $1,800.

The annual federal gift exclusion will increase from $16,000 to $17,000 per recipient.

HSA contribution limits will increase from $3,650 to $3,850 for individuals and from $7,300 to $7,750 for families. We like this account type very much due to its triple tax-advantaged status.

We look forward to continuing our work together in 2023!