Getting Ahead of Tax Time

If you’ve already finished filing your 2022 tax return—congratulations! If you haven’t, commiserations and good luck. Because those wounds are still fresh, we wanted to take this opportunity to review some strategies around tax planning that we’ve implemented in recent years to try to help save you money, either now or down the line. Below we’ve listed some strategies that help working and retired clients alike, as well as those who are charitably minded, so read on to see what might fit you best.

Don’t Underestimate Your 401(k) (or 403(b), or 457, or…)

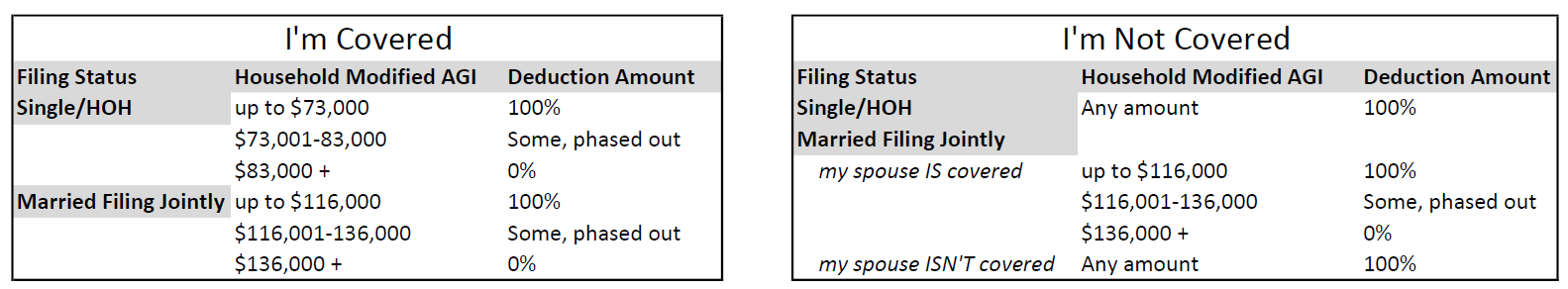

Our pre-retirement clients who use a tax software to file may be familiar with the lure of being told, “If you contribute $X to your pre-tax IRA for last year, you’ll save $Y on taxes!” But the ability to lower your taxes through these contributions isn’t available to everyone. The IRS limits your ability to get a tax deduction for pre-tax IRA deductions based on whether you are “covered by a retirement plan” at work.

What does “covered by a retirement plan” mean? It’s complicated (isn’t everything tax-related?). If you have access to a retirement plan at work and money is being added—whether by you or an employer—you are covered. (For our Oregon PERS clients, your IAP isn’t considered.) If you have a retirement plan at work but nobody’s putting any money into it, you aren’t considered covered, which means you may be able to get a tax deduction.

To figure out whether you can get a deduction, first figure out whether you’re covered by a retirement plan or not. Then, use the charts below to figure out if you can deduct IRA contributions based on your income.

Be Strategic With Generosity

You can only deduct your charitable contributions if you itemize your deductions, but after the Tax Cuts and Jobs Act increased the standard deduction, many people lost the ability to take these deductions. For charitably inclined clients, we suggest “bunching” charitable contributions—if you like to give to organizations yearly, make donations in January and December of the same calendar year. That way, you double your charitable giving line item and increase your chance of getting more credit on your taxes.

If you have one really big income year on the horizon but like stretching out donations over years, one option is a donor advised fund. You open a charitable account that you control, and contributions into that account get a tax deduction in the year they are made.

Pay Taxes On Purpose

We can hear the boos from here, but sometimes it makes sense to pay taxes on purpose now when we know you’re paying less than you will later. We discussed Roth conversions at length in 2022, but to recap: a Roth IRA is one of the best tax buckets we have, because while it doesn’t get you a tax break up front, there are no taxes on dividends, capital gains, or withdrawals, as long as you’re 59 ½ or older when you take money out. You can fund a Roth IRA by moving in some of your pre-tax IRA. When you convert that IRA money, you pay income taxes, both federal and state, in that tax year.

If you expect your income to be higher in the future, and you might pop up a tax bracket when that happens, we might want to pre-pay at the 12% federal rate instead of the 22% rate down the line. Most commonly, this affects our retired clients who aren’t yet taking Social Security or RMDs, but it also can be a great option for part-time workers, future career changers with big income upside, and folks who are early in their career.

The strategies we’ve listed here have a lot of nuances to them, and we want to make sure we’re looking at your unique situation when making decisions. If any of this sounds interesting to you, please reach out to me to help figure out what best fits your needs.